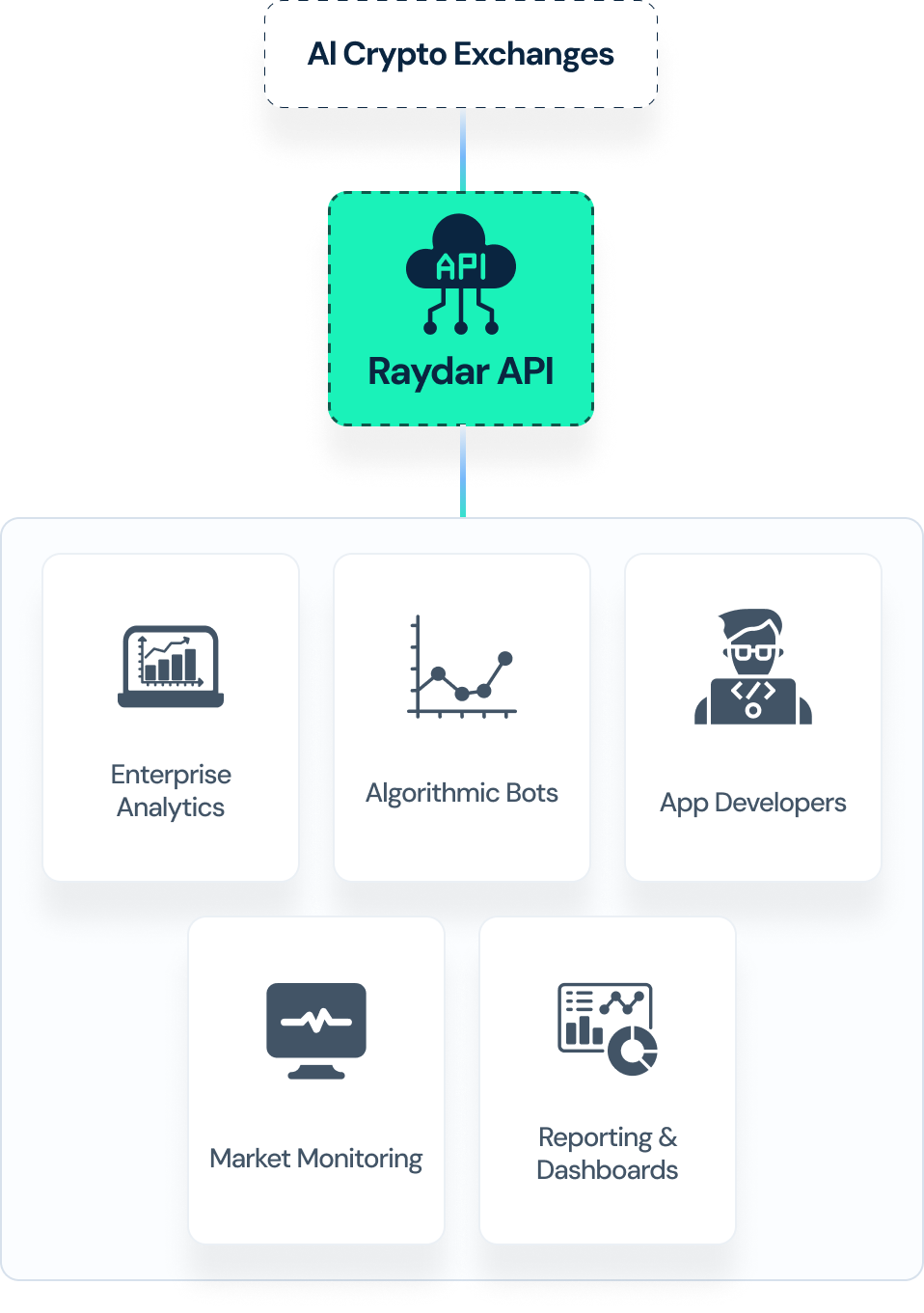

Raydar API

A powerful data infrastructure to enable everything you need in crypto.

Raydar API provides a powerful and scalable data infrastructure for both individual and enterprise clients in the crypto ecosystem.

RCXT

Access price, volume, and market depth data through a single channel with the Raydar API.

Get InformationCompare Plans

Explore the features of all atWallets products and discover the plans that best suit your crypto strategy.

Who is RTicker for?

Discover the use cases to understand the power of R-Ticker.

Developer-First, User-Scoped

Programmatic access to Raydar App capabilities (portfolio, balances, orders/trades, alerts, performance views) primarily scoped to the end user. Build your own Raydar-like UI without a backend rewrite.

- Ready business logic: Portfolio valuation, allocations, alerts and performance KPIs exposed as clean endpoints.

- Normalized joins: Accounts, venues, assets and time series align under one schema.

- Export-friendly: CSV/PDF-ready payloads for statements and reviews.

- Access hygiene: API-key auth and user-level scopes; honor upstream exchange limits.

Backend-less analytics for your brand.

Who Uses It

Indie devs • Fintech frontends • Family offices • Pro users building custom dashboards

Boundaries & Rates

- No package-guaranteed overrides: request pacing follows exchange-side rate limits; client throttling is documented for stable UX.

- Multi-tenant admin/role models are not the focus today; API is primarily user-scoped.

What You Can Build Fast

White-label market tabs, investor portals, alerts, performance pages — with minimal backend code.

- Portfolio & exposure pages with allocation charts and look-through positions.

- Order/trade histories with filters and export buttons out of the box.

- Alert endpoints for thresholds/volatility wired to users’ holdings.

Ship features, not infrastructure.

Scenarios

Brokerage add-ons • Client portals • Pro workspaces

Roadmap Notes

- R-Big Data and Raydar AI integrations are planned; timelines will be published before GA.

Data Surface (Honest List)

Market data via RCXT/R-Ticker, portfolio/alerts via Raydar App; heavy history via R-Big Data.

- Market: Real-time prices/books (venue dependent), consolidated via RCXT/R-Ticker.

- User: Balances, orders, trades and alerts aligned to the user account.

- History: Deeper time series and research datasets provided by R-Big Data (roadmap).

Clear responsibilities prevent confusion.

CTAs

View API Docs • Start Integration

Compliance Tone (Realistic)

- Respect user privacy and exchange terms; store only what’s required for the feature.

Examples & Patterns

Reference flows to copy into your app with minimal changes.

- Portfolio screen: GET /portfolio → charts/tables → export CSV/PDF.

- Alerts: POST /alerts (threshold/volatility) → webhook/email/mobile push via your channels.

- Orders/trades: GET /orders, /trades with pagination/filters for reviews.

Short paths to value.

Who Benefits

Front-end teams, indie builders, fintech PMs

Notes

- If you want everyone to build a full ‘Raydar’ on top: this API is the starting point, not a full enterprise multi-tenant stack.

Frequently asked questions

We haveput together some commonly asked questions

Contact us to design a custom package tailored for your business.

Let us help you find the right product.

Contact the sales team